Table Of Content

Pay OnlineTo make an electronic payment for property taxes via the Department of Treasurer and Tax Collector’s website. This is not a payment through your bank’s online bill payment or home banking functions. Unless you're a real estate tax law rock star (few people are), you should plan on working with someone who is. Find a trusted tax accountant or CPA to guide you through the process of buying, operating, and selling investment property. That way, you'll get the best tax treatment possible and avoid any surprises at tax time.

These are some of the oldest restaurants in Orange County

You can, however, deduct assessments (or taxes) for local benefits if they are for maintenance, repair, or interest charges related to those benefits. An example is a charge to repair an existing sidewalk and any interest included in that charge. You can’t deduct amounts you pay for local benefits that tend to increase the value of your property. Local benefits include the construction of streets, sidewalks, or water and sewer systems.

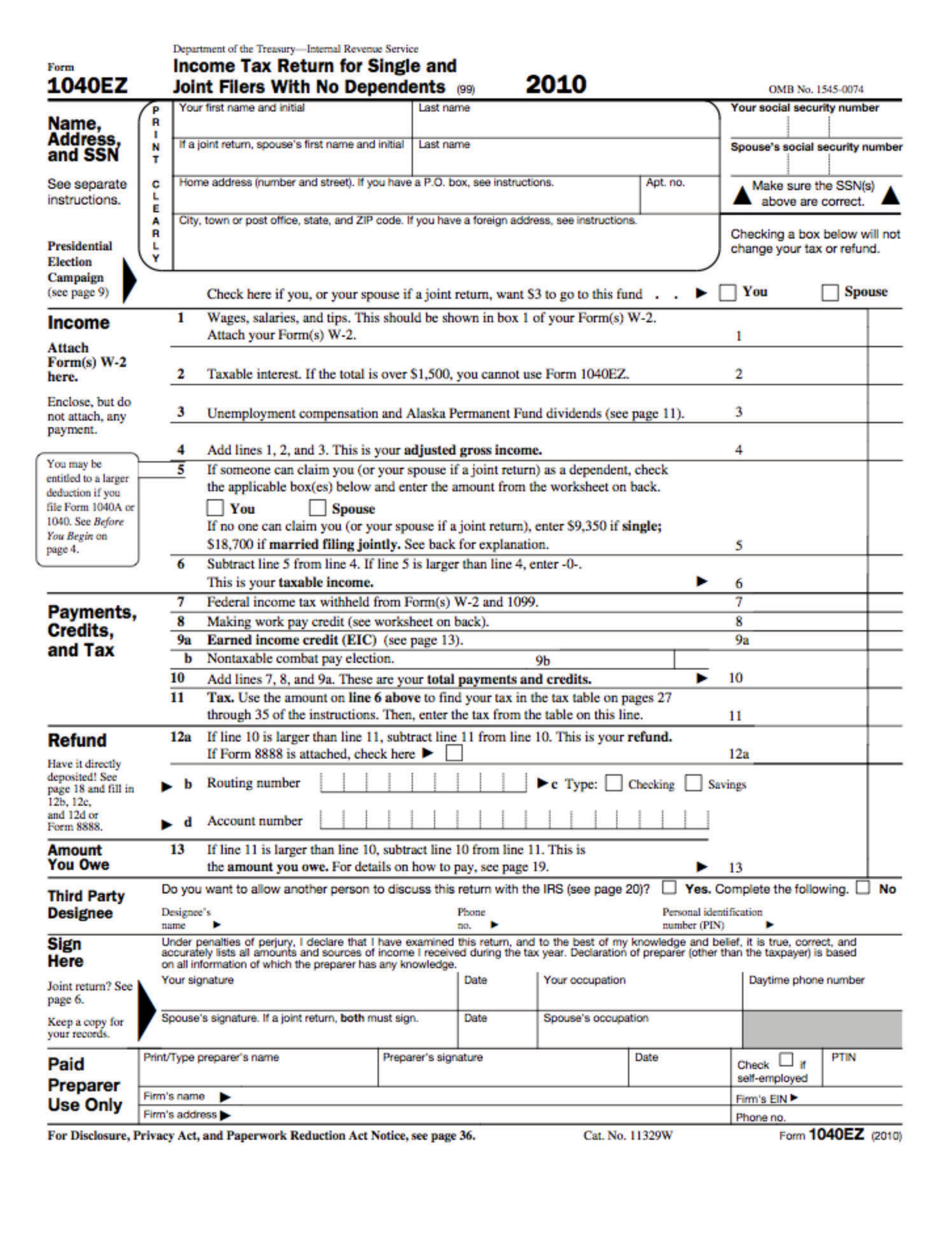

Credits & Deductions

Houston may raise property taxes. How would your bill change? - Houston Chronicle

Houston may raise property taxes. How would your bill change?.

Posted: Wed, 24 Apr 2024 19:03:58 GMT [source]

If you spread your deduction for points over the life of the mortgage, you can deduct any remaining balance in the year the mortgage ends. A mortgage may end early due to a prepayment, refinancing, foreclosure, or similar event. The buyer must also reduce the basis of the home by the amount of the seller-paid points. For more information about the basis of your home, see Basis, later. You can deduct the rest of the points over the life of the loan. Your deduction for home mortgage interest is subject to a number of limits.

How do I calculate property taxes?

Your payment schedule will depend on how your county collects taxes. Property taxes are levied on real estate by governments, typically on the state, county and local levels. In fact, the earliest known record of property taxes dates back to the 6th century B.C. While some states don't levy an income tax, all states, as well as Washington, D.C., have property taxes. The Tax Office accepts e-checks, credit cards and debit cards for online payment of property taxes.

Here’s how to calculate property tax so you don’t end up blindsided by this hefty homeowner expense. If you already own a home, you can look at how your tax is calculated on the most current property tax statement. If you’re considering buying a home, look on the real estate listing for assessment and tax information, or go to the county website to find out the annual property tax. Most people know that homeownership requires coughing up copious amounts of money. There’s your mortgage, of course, but the costs hardly end there.

The credit rate for property placed in service in 2022 through 2032 is 30%. If you own your own home, you might be able to save on your tax returns. Get the most value from your home with these eight tax deductions. Both types of property can be deducted from federal taxes. However, since the Tax Cuts and Jobs Act of 2017, the deduction has been capped at $10,000 per year for married couples and single taxpayers.

Georgia Has a New 2024 Income Tax Rate - Kiplinger's Personal Finance

Georgia Has a New 2024 Income Tax Rate.

Posted: Tue, 23 Apr 2024 21:15:20 GMT [source]

PROPERTIES REMAINING FOR SALE

Hawaii had the lowest rate, at just 0.31%, followed closely by Alabama at 0.39% and Louisiana at 0.54%. If you own a house, you’re probably familiar with property taxes. Your local government collects real estate taxes to help pay for services and projects that benefit the community -- emergency services, libraries, schools, roads, and the like. Census Bureau, the median home value in Fresno County is $271,000.

Apply for tax exemptions and abatements

Instead, you add the $1,375 to the cost (basis) of your home. The basis of a home you bought is the amount you paid for it. This usually includes your down payment and any debt you assumed.

Income Method

While most U.S. homeowners must pay property taxes, some properties are exempt. This differs from a tax deduction, which only lowers an individual or group’s tax liability. Property tax exemptions include qualifying individuals, such as senior citizens, STAR (School Tax Relief) participants, those with disabilities and veterans. Certain eligible government, nonprofit, and religious entities may also fall under an exemption. While your home’s assessed value for property taxes may match its actual value, that won’t always be the case.

The certified appraisal roll and the tax rates are used to levy the current property taxes in October/November of each year. Tax statements are then printed and mailed to property owners and mortgage companies. Most tax payments are mailed to a lockbox at the County depository. There the payment documents are scanned, and the checks are deposited and recorded.

Along with the countywide 0.82% tax rate, homeowners in different cities and districts pay local rates. Some states or local governments send a property tax bill annually, while others charge semi-annually or quarterly. Alternatively, property taxes can also be included in your mortgage payment, if you have an escrow account with your mortgage servicer. Overall, homeowners pay the most property taxes in New Jersey, which has some of the highest effective tax rates in the country. The state’s average effective rate is 2.47% of a home's value, compared to the national average of 1.02%.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. Here is a list of our partners and here's how we make money.

No comments:

Post a Comment